Read the original article by Pierre Bouvard at Westwood One »

Click here to view a 12-minute video of the key findings.

Click here to download a PDF of the slides.

As automakers contemplate audio entertainment designs for their vehicles, several questions are raised:

- What is the current state of audio time spent among U.S. drivers?

- How do the audio habits of auto brand owners differ?

Key takeaways:

- For product design and operations teams at auto manufacturers, it is important to understand the massive use of AM/FM radio among in-car listeners

- For auto brand marketing teams, AM/FM radio is a powerful platform to reach American drivers to build auto brands and reach auto intenders

- Among Tesla owners, AM/FM radio is the most listened to audio platform, podcasts are huge, and SiriusXM is much smaller

- Among all U.S. drivers, AM/FM radio is the queen of the road with an 85% share of in-car ad-supported audio

- The proportion of AM/FM radio listening occurring in-car has rebounded to pre-pandemic levels

Third annual Edison “Share of Ear” report among auto brand drivers

For the third year, the Cumulus Media | Westwood One Audio Active Group® conducted a special auto brand analysis of Edison’s “Share of Ear,” the long running audio tracking study.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Over the last eleven years, Edison Research has surveyed 4,000 Americans annually to measure daily reach and time spent for all forms of audio.

“Share of Ear” captures audio use among auto brands’ drivers. Since the inception of the study in 2014, Edison has asked, “What is the model year and brand of your primary car or truck – that is, the one vehicle you spend the most time driving or riding as a passenger?”

This new Edison “Share of Ear” data among auto brand drivers serves two purposes. First, it helps product design and operations teams at auto manufacturers understand the massive use of AM/FM radio among their customers. For the auto brand marketing teams, it reveals how AM/FM radio is an ideal marketing platform to reach American drivers and in-market auto buyers.

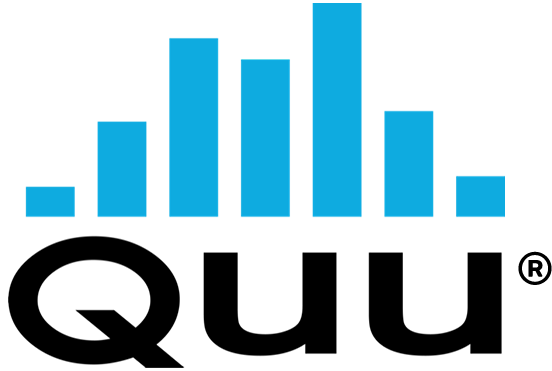

Of all U.S. in-car minutes spent with audio, 66% is spent with ad-supported audio and 34% goes to ad-free audio

Throughout this report, we will examine in-car shares against two universes: all audio tuning and ad-supported listening. Auto design teams want to understand the totality of all in-car listening. Auto marketers are focused on media platforms that accept advertising.

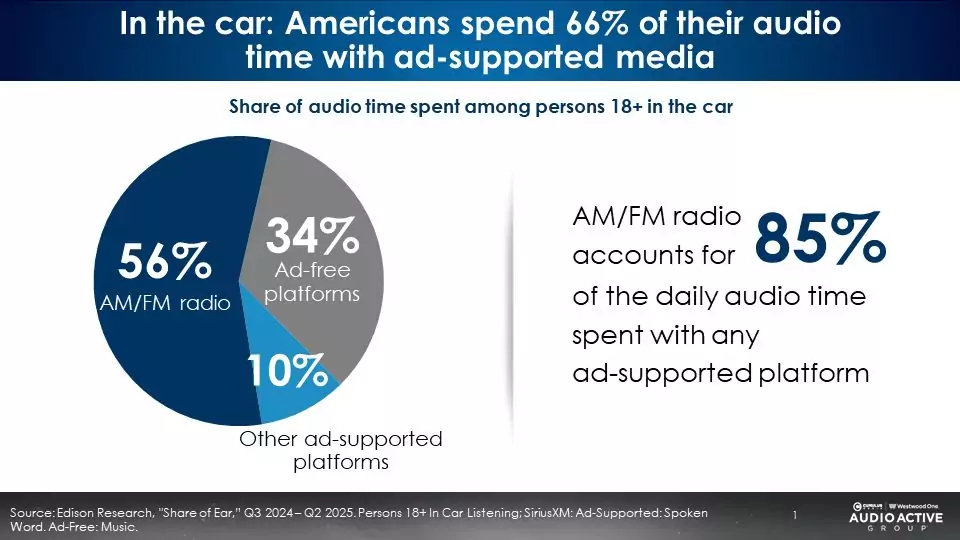

Among U.S. drivers, AM/FM radio has a 56% share of all audio time spent in the car

According to the Q2 2025 “Share of Ear,” 56% of all forms of in-car audio minutes goes to AM/FM radio. This includes both ad-free audio content as well as ad-supported audio.

At a 13% share, SiriusXM’s ad-free music channels place a distant second. Spotify’s ad-free subscription service places third with a 6% share.

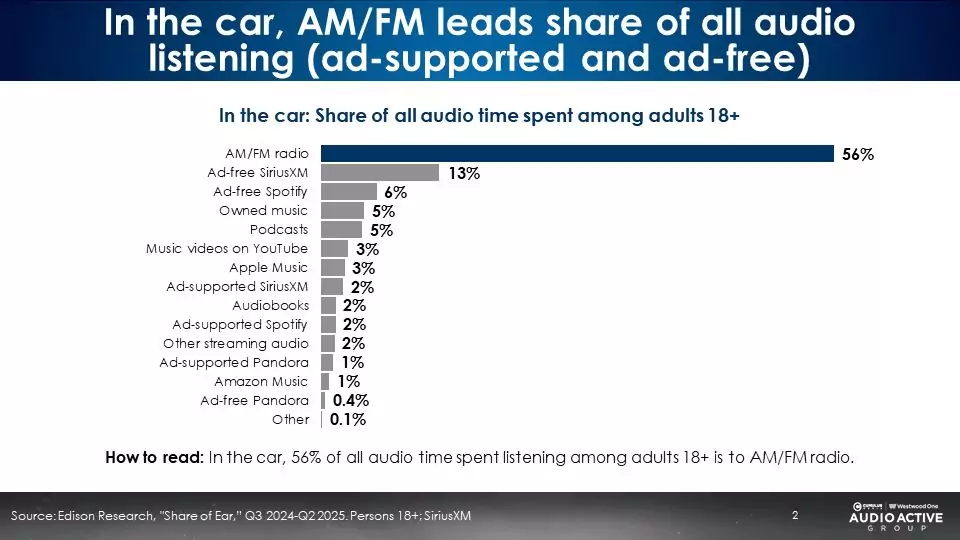

AM/FM radio is the queen of the road with an 85% share of in-car ad-supported audio

Of all the ad-supported listening that takes place in the car, AM/FM radio has a massive 85% share. What better place to build an auto brand with auto intenders than among in-car consumers daydreaming about their next vehicle?

Auto brand in-car listening: Consistent shares to all audio by OEM parent and auto brand

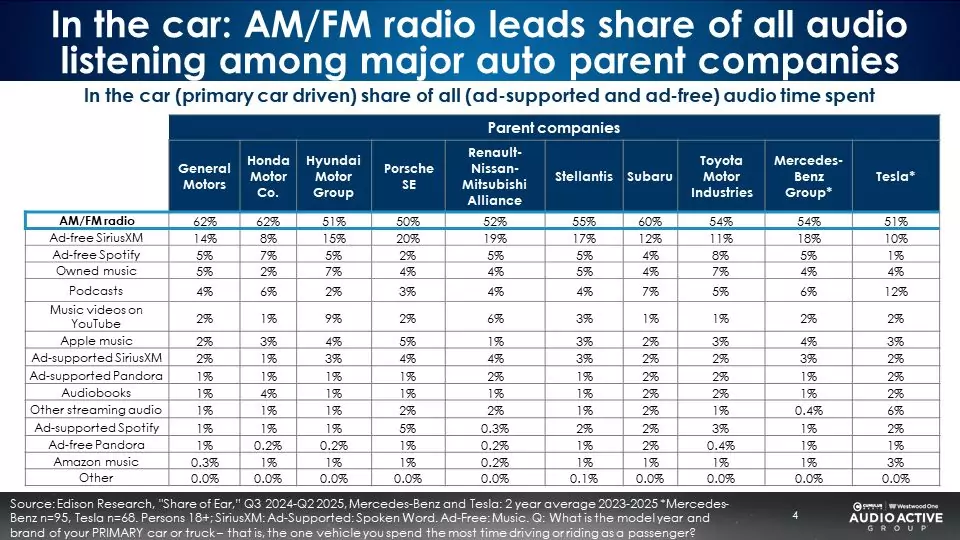

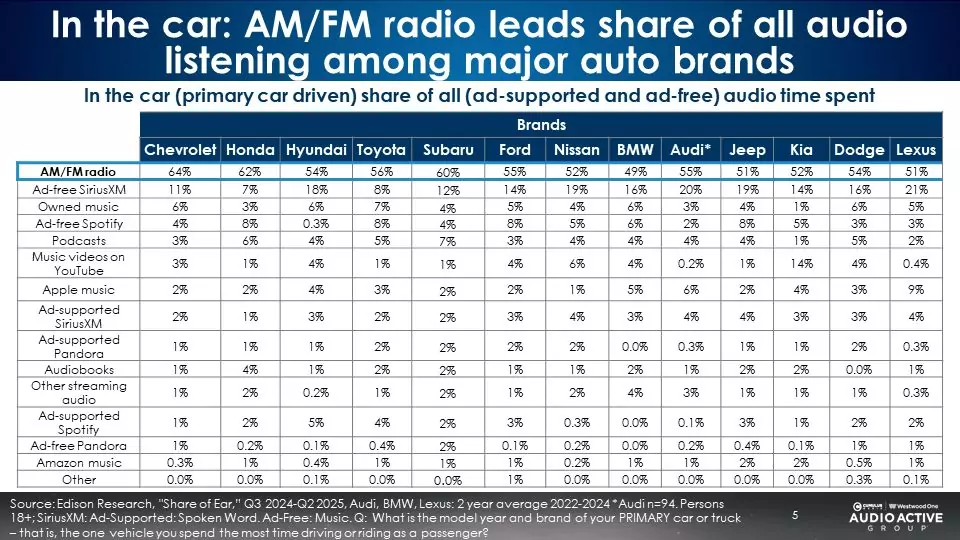

The charts below depict in-car audio shares for all forms of audio among auto brand drivers. The first table includes in-car shares rolled up to the OEM parent company. Below that are in-car shares among auto brand drivers.

Across all auto brands, AM/FM radio represents 50% to 60% of all in-car audio time spent.

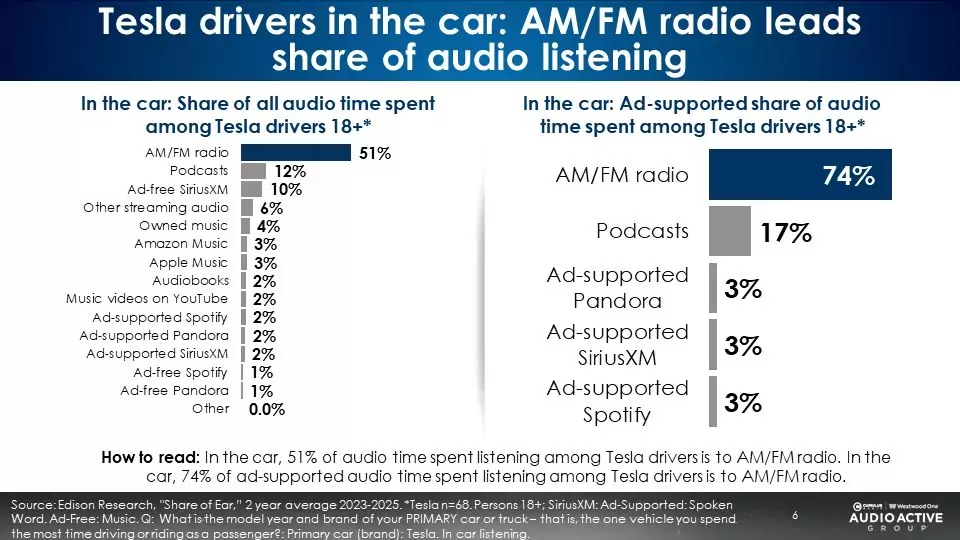

Among Tesla owners, AM/FM radio is the most listened to audio platform, podcasts are huge, and SiriusXM is much smaller

When it comes to SiriusXM and podcasts, Tesla owners show different listening patterns from the norm. While AM/FM is by the far the most listened to platform, ad-free SiriusXM is much smaller among Tesla owners versus other brands. Conversely, podcasts have a much larger share among Tesla owners.

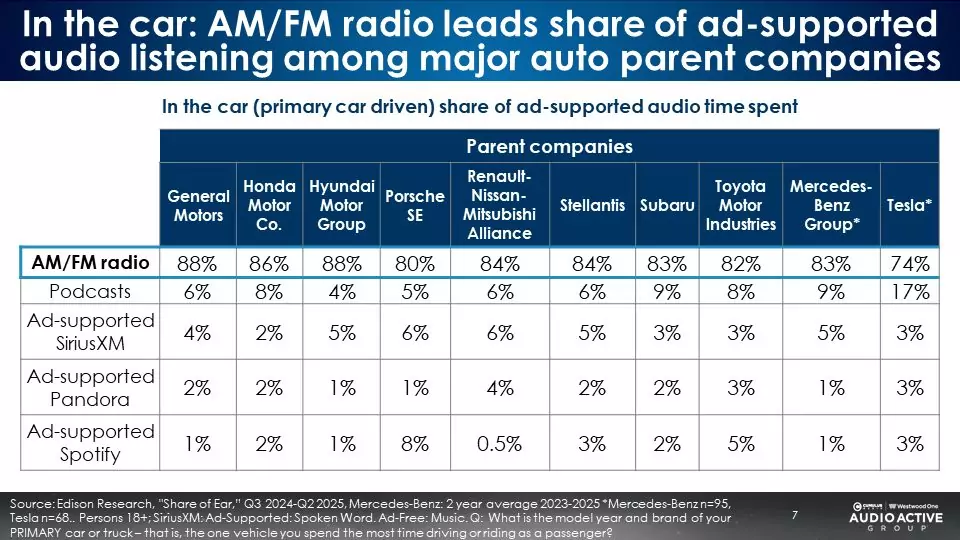

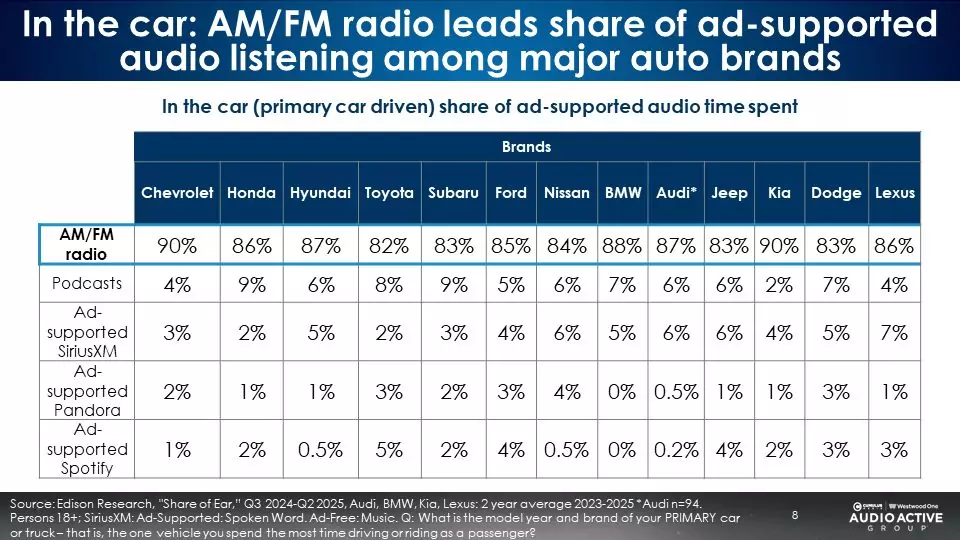

Ad-supported auto brand in-car listening: Consistent shares by OEM parent and auto brand

The tables below represent ad-supported in-car listening shares among brand drivers. First are in-car shares rolled up to OEM parent company drivers. Next are ad-supported in-car shares among auto brand drivers. With an average ad-supported in-car share of 85%, these charts depict the huge opportunity that AM/FM radio affords auto marketing teams.

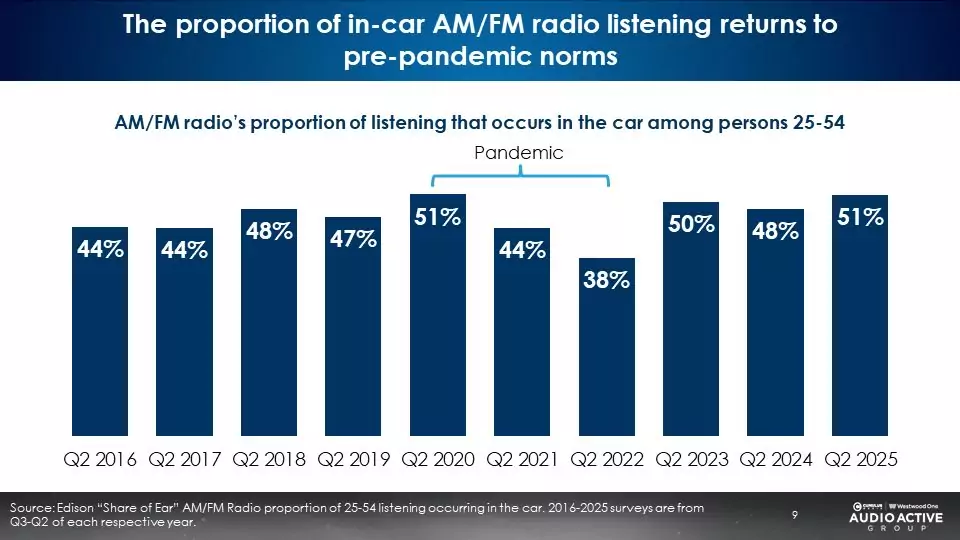

The proportion of AM/FM radio listening occurring in the car has rebounded to pre-pandemic levels

Here is the ten-year trend of the proportion of AM/FM radio listening occurring in the car:

In the five years before the pandemic (2016-2020), in-car listening represented 48% of all AM/FM radio listening. During the pandemic years (2021-2022), the in-car share dropped to a low of 40%.

In 2023, the proportion of AM/FM radio listening in the car grew twelve points from 2023 (38% to 50%). Since then, the proportion of total AM/FM radio listening occurring in car has held steady at 50%, returning to the pre-pandemic norms.

Key takeaways:

- For product design and operations teams at auto manufacturers, it is important to understand the massive use of AM/FM radio among in-car listeners

- For auto brand marketing teams, AM/FM radio is a powerful platform to reach American drivers to build auto brands and reach auto intenders

- Among Tesla owners, AM/FM radio is the most listened to audio platform, podcasts are huge, and SiriusXM is much smaller

- Among all U.S. drivers, AM/FM radio is the queen of the road with an 85% share of in-car ad-supported audio

- The proportion of AM/FM radio listening occurring in-car has rebounded to pre-pandemic levels

Click here to view a 12-minute video of the key findings.